Mexicans should remain calm in the wake of Donald Trump’s decisive election win, the president of the US’s largest trading partner and southern neighbor said, sounding a note of pragmatism as local markets rebounded from their initial shock.

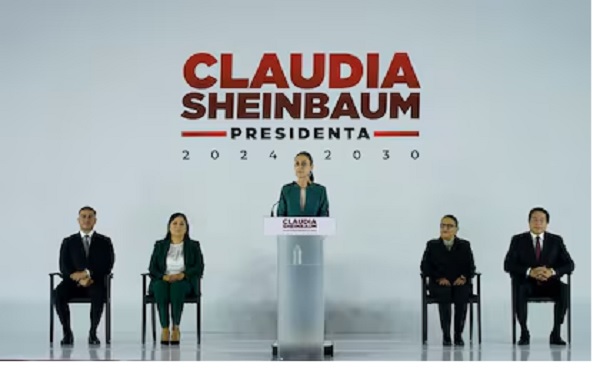

“Mexico is a free, independent and sovereign country and we’re going to have a good relationship with the US,” President Claudia Sheinbaum said during her daily news conference. “I’m sure of that.” She waited until after Kamala Harris’s concession speech later in the day to congratulate the president-elect, becoming the last major Latin American leader to do so.

In a show of Mexican economic might, Sheinbaum posted photos on social media Wednesday of her meeting at the National Palace with Larry Fink, chief executive officer of BlackRock Inc., and with Adebayo Ogunlesi, head of Global Infrastructure Partners, the private equity firm BlackRock acquired this year. They discussed the economy and free trade in the region, she said.

Her confident air was a contrast to a nerve-rattling morning in the markets, where investors were weighing how to price in Trump’s campaign pledges to impose tariffs on imports from Mexico and a promise to send millions of migrants back over the border. Some four-fifths of Mexico’s exports go to the US, earning it more than $475 billion last year alone.

The peso whipsawed through the session, falling as much as 3.5% as results rolled in overnight, but ended the Wednesday session 0.1% stronger at 20.09 per dollar. Still, the currency has lost more than 15% of its value this year, the worst of any major currency, on concern about the US election and some of Sheinbaum’s policies. Mexico’s benchmark stock index also turned positive after sliding as much as 2.7% earlier in the session. It has dropped nearly 11% this year.

Investors were buying both the peso and Mexican stocks on bets that Trump would end up working with Sheinbaum despite his campaign rhetoric, said Luis Gonzali, a Mexico City-based money manager at Franklin Templeton.

“This was really priced in compared to 2016 when Trump was a surprise,” Gonzali said. “This time, the promises are not positive, but they are not existential. There is more room for negotiations.”

Investors are waiting to see whether Republicans retain control of the US House of Representatives after winning back the Senate, said Francisco Campos-Ortiz, an economist at Deutsche Bank in New York. A so-called Red Sweep would give Trump the support he needs to push his policies forward.

“That can be to the detriment of Mexico and the rest of the world when it comes to migration and trade policy,” Campos Ortiz said.

Even without a Red Sweep, Mexico is likely to be hit by tariffs under Trump’s plan, fueling a selloff in Latin American currencies, according to Citigroup strategists. After Trump’s surprise victory in 2016, the currency lost roughly 10% in a week, according to data compiled by Bloomberg.

As recently as this week, Trump pledged to impose a 25% tariff on all goods from Mexico if the country doesn’t help stem the flow of immigrants. He said he hadn’t met Sheinbaum but that he would be in touch with her on his first day as president.

Mexico has a free-trade agreement with the US and Canada, negotiated under the previous Trump administration, and the countries’ trade and economic interdependence has only grown as the US has tried to reduce its reliance on Chinese goods.

Every major automaker has plants in Mexico, with most of them exporting vehicles to the US, but Trump’s reascendance has already caused car companies to think carefully about how they invest in the country. Elon Musk, who in 2023 announced a Tesla gigafactory in the Monterrey area, has been holding off on building it to gauge how the US election would affect the plan.

Chinese electric-vehicle maker BYD Co. has been scouting locations for a Mexico plant but had also delayed announcing until after the election, Bloomberg reported in September. The automaker declined to comment on Wednesday, November 6th.

“I do not see any feasibility for Chinese companies to establish production lines to export to the US,” said Guillermo Rosales, head of Mexico’s Association of Automotive Dealers. Agreements between the countries will make it difficult for the US to apply tariffs to companies already established in Mexico, he said.

An increase in tariffs could affect Mexico’s ability to jumpstart its economy, which has been slowing since the end of last year. Mexico has been trying to take advantage of a trend known as nearshoring, where foreign companies relocate to the country to be closer to the US — a phenomenon driven in part to avoid tariffs Trump imposed last time he was in power, and partly because of supply chain disruptions during the pandemic.

Some companies are pressing ahead with investment in Mexico. Foxconn recently announced it was building the world’s largest assembly plant in Mexico for servers housing Nvidia’s most advanced Blackwell chips.

Two prominent members of Sheinbaum’s cabinet, Economy Minister Marcelo Ebrard and Foreign Minister Juan Ramon de la Fuente, have experience working with the previous Trump administration in previous roles.

CLICK HERE TO READ THE FULL ARTICLE ON BLOOMBERG