If you or someone you know has a Mexican passport or resident card, they might be leaving money on the table when they purchase airline tickets to/from/through Mexico.

When you purchase a plane ticket to Mexico, the fare has a tourism tax built in – similar to US customs and immigration fees. This fee goes toward the cost of immigration processing and the arrival / departure card required for foreign visitors. The fee is 390 Mexican Pesos, which is roughly $20 USD.

However, not everyone is required to pay this fee. If you have a Mexican passport or resident card, or are spending less than 24 hours in Mexico, you’re exempt from this tax. (Infants under 2 and diplomats are also exempt.) This is outlined (in Spanish) on this Mexican government FAQ page, question 16.

Mexican carriers typically know not to charge this fee to Mexican citizens based on the citizenship information you enter at the time of booking, but otherwise, there’s a good chance this fee will end up on your ticket even when it shouldn’t. (There’s actually a class action lawsuit pending against several US and Mexican airlines for this practice.) Fortunately, most airlines are pretty good about giving you a refund upon request.

Alaska Airlines

Difficulty: EASY

I haven’t flown to Mexico on Alaska yet, since they don’t fly to Mexico City, but they were the first airline I found that documents the existence of this tax refund on their website. You can present your documentation to an airline representative at checkin to have a refund request submitted for you, or you can submit copies by mail or fax after travel is completed.

American Airlines

Difficulty: EASY

American now has a page on their website about Mexico tourism tax refunds too. In the past, I used to submit refund requests via Twitter. Now, you can contact Reservations before your trip, or submit a refund request through their website after travel has been completed. The online refund request is very easy – I just selected ‘refund of taxes’ as the reason and uploaded a copy of my resident card, and the refund was back on my credit card within a few days.

Delta Air Lines

Difficulty: HARDER

Delta has information about tourism tax refunds buried on their Legal Notices page, and also on their “Pro” website for travel agents. The Legal Notices page directs you to their online refunds tool, but when I tried to submit a request for a refund for a previous flight, I got a big fat error message. Attempting to request a refund for an upcoming flight forces you to cancel the ticket first, which isn’t helpful either. I reached out to their Twitter team for assistance, but they told me to call the International Reservations Sales Team at 1-800-241-4141 for assistance. Stay tuned.

No luck requesting a refund from Delta online.

Jetblue Airways

Difficulty: IMPOSSIBLE

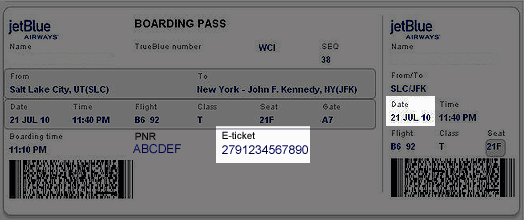

JetBlue has an unnecessarily convoluted system for requesting tax refunds. In theory, it’s relatively simple: you show your receipt and your documents to Jetblue agents at checkin and they submit the refund request on your behalf. In practice, this is way harder than it sounds. Their Twitter team told me that you can’t just submit a copy of your e-ticket – you have to request a Comprobantes Fiscal Digital por Internet (CFDI) receipt through a third party website at least 48 hours but no more than 30 days after purchase.

This website (in Spanish) is buggy and full of inaccurate and conflicting information. For example, on the first page you have to enter your ticket number and date of purchase, but if you enter the actual date of purchase it doesn’t work. The site shows a sample boarding pass with the ticket number and departure date highlighted, but that doesn’t work either – their system doesn’t allow you to select dates in the future.

When I reached out to their Twitter team for help, they suggested entering the date I was requesting the receipt as the date of purchase (even though I bought the ticket last month) – that didn’t work either. Their Twitter team then directed me to email [email protected], who couldn’t help with a receipt or refund, but sent me a $50 Jetblue voucher for my trouble.

Southwest Airlines

Difficulty: NOT SO BAD

I’ve had good luck getting Southwest to refund tourism taxes via Twitter. Since Southwest tickets are so flexible, you have to wait until travel is completed to submit a refund request. Their Twitter team told me to fax a copy of my documents to their Refunds Department (972-656-2568) with my confirmation number. The first time I requested a refund, it took nearly two months – I submitted my documents on April 5, and didn’t receive a refund until the end of May. When I followed up with the Twitter team on May 20th, they said the Refunds department was still handling requests from March 21st. However, I submitted a request for a different ticket via Twitter on October 4th and was able to get a refund processed the next day without having to resubmit my documents.

United Airlines

Difficulty: EASY

United has also been great about processing refund requests via Twitter, on both award and paid tickets. Last time, they directed me to the United Refunds website, but when I told them I wasn’t sure which option to choose on the website, they processed my refund manually instead. (I suspect selecting “Contact United Refunds” would ultimately get you the same result).

Aeromexico

Difficulty: EASY

The first time I traveled to Mexico, I had separate tickets from LAX to Mexico City and an onward connection (within 24 hours) from Mexico City to Santiago, Chile – which meant that I was exempt from both the tourism tax and Mexico City’s steep international departure tax. If I had booked that as a single ticket, those taxes would have been removed automatically, but their US refunds team (amusrefunds@aeromexico.com) was able to process the refund quickly. That’s also the department for requesting tourism tax refunds based on citizenship or residency – just email them your ticket number and a copy of your passport or residency card.

All Nippon Airways (ANA)

Difficulty: HARDER/TBD

I booked an ANA award ticket earlier this year that included a United segment from SFO to Mexico City. I reached out to ANA on Twitter and was directed to call them at 1-800-235-9262 for assistance. But I hate making phone calls, so I haven’t gotten around to it yet.

Air France / KLM

Difficulty: IMPOSSIBLE

Last year, I booked two award tickets for my partner on Aeromexico using Flying Blue miles and was charged tourism tax on both tickets. I tried multiple times to reach out to Flying Blue, Air France / KLM, Delta (which handles some of their customer service in the US), and Aeromexico, both myself and through an agent at getservice.com. Air France told us to contact Aeromexico, and subsequent requests to contact either airline – even through executive channels – were met with complete silence. Ultimately, getservice recommended that I initiate a chargeback with my credit card company, and I also considered filing a complaint with the US Department of Transportation, but at that point the tickets were so old that I didn’t want to bother with it anymore.

Volaris

Difficulty: IMPOSSIBLE

The Volaris website asks you if you have a Mexican passport when you book your ticket, but since I have a US passport, there is no way to avoid being charged the fee automatically. I reached out to their Twitter team for advice, who incorrectly told me that since I have a foreign passport, I have to pay the fee regardless of my residency status.

I then reached out to the Volaris chat support team, who directed me to email Customer Relations at [email protected]. I’ve gone back and forth with them via email multiple times – they don’t seem to have a great grasp of how the law works, and in any case have decided that it’s my fault that the tax was charged because I selected “US Citizen” instead of “Mexican Citizen” at booking. Their policy (apparently) is that customers are completely responsible for whatever charges appear on the website at time of booking, and it sounds like they wouldn’t refund me even if I had a Mexican passport. Volaris told me that to avoid this fee in the future, I should just say that I am a Mexican citizen during the booking process. I ended up filing a chargeback on my Citi Prestige card, but since the amount was so small Citi just granted me a permanent credit without investigating.

“Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied.”

Final Thoughts

Frankly, this is an annoying process and requires quite a bit of record keeping and hassle. The savings definitely add up over time, due to the amount of travel that I do. The amount of money saved on taxes will more than cover the cost of my one-year temporary resident card. There’s relatively little information about this process online, so I’m hoping this article will help people save some time and money. I still have a few unresolved tax issues, but hopefully the refund process gets simpler, easier, and quicker in the future.

Do you have any experience requesting tax refunds from an airline? If you have any questions, please let me know in the comments. Adios amigos!

Do you have any experience requesting tax refunds from an airline? If you have any questions, please let me know in the comments. Adios amigos!

Source: http://travelwithgrant.boardingarea.com/

!["Thank you for writing, I inform you that [a refund] is not possible since on the return flight you would be entering Mexico as a foreigner, which is why the charge was applied."](http://travelwithgrant.boardingarea.com/wp-content/uploads/2016/12/Screen-Shot-2016-12-18-at-9.49.27-AM.png)