Forex market is a difficult but it doesn’t mean you cannot master it. If you want to master the Forex market you should have the real need for it. You should have the urgency to commit yourself to the trading world. The traders who enter the market with less knowledge have the tendency to leave the market right away. Why do you think it happens? Usually, if the naive trader deals with a lot of stress this kind of situation could arise. As naïve traders it is no wonder that they face such situation. When a naïve trader enter the live trading environment he may encounter the risks, challenges and other difficulties in the trading world. Just imagine, when a trader face these issues once he enter the market, how would his mind react? How would he feel? Of course, he may get frustrated yet there are solutions for this.

The trader must know to take necessary actions to avoid these issues. If the Singaporean traders were capable of taking necessary actions why can’t the naïve traders take the required actions? If the Singaporean traders were able to reduce the trading stress why can’t the naïve traders reduce the trading stress? It is all about how the trader reacts. The naïve traders shouldn’t enter into risky trades rather they should go easy at first. Once they become familiar with the market, they can aim better trades. `Anyway, you are here to learn the way to reduce trading stress. Let us get started!

Don’t try to do the impossible things

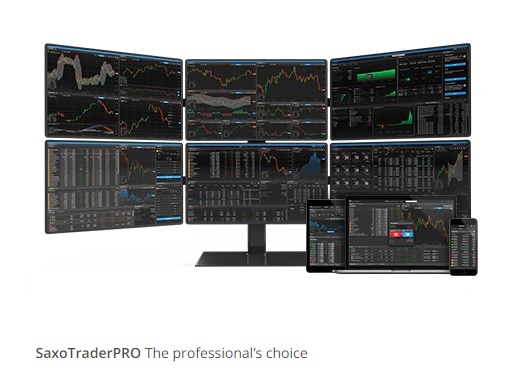

Most naïve traders have the habit of following the professional traders and they tend to do the impossible things. For example, if the professional traders risk a large amount, the naïve traders also tend to follow it. But this kind of actions will create unnecessary stress. Usually, naïve traders create unnecessary stress in most situations. Another example would be when selecting a trading platform. The naïve traders don’t do their best to find the right platform rather they just aim for some random platform which leads to unnecessary stress. If you try to do impossible things you will definitely end up creating trading stress. So what should you do? You should one thing and i.e. practice as much as you can. If you practice a lot, you wouldn’t have to follow another trader to meet your trading goals.

Stay safe when necessary

You may come across different market situations. You may face risky situations but as a naïve trader, you should know what to avoid and what not to avoid. If certain trades seems too risky to enter, you should just avoid it because you are new to the market. On the other hand, a professional trader doesn’t have to think about these issues because he has the experience.

Be vigilant about the stop loss

If you want to avoid losing your hard earned money you should be vigilant about the stop loss. A stop loss will keep your losses at bay. If you have the proper idea on stop losses you can easily protect your account from losses. You may come across a lot of risks but you should have the ability to cut it short and it will reduce stress.

Take some break

You are not a robot and you can’t monitor the price movement 24 hours a day. As a full-time trader, you must find some other things to do in your life. If you get involved in this market as an addict you will never become a successful trader. At times you have to go out for vacations and spend quality times with your family members. That’s the point of making tons of money when you can’t live your life with a big smile. You need to find the perfect balance to become a successful trader. And trade during a specific hours only.

More info go to saxo